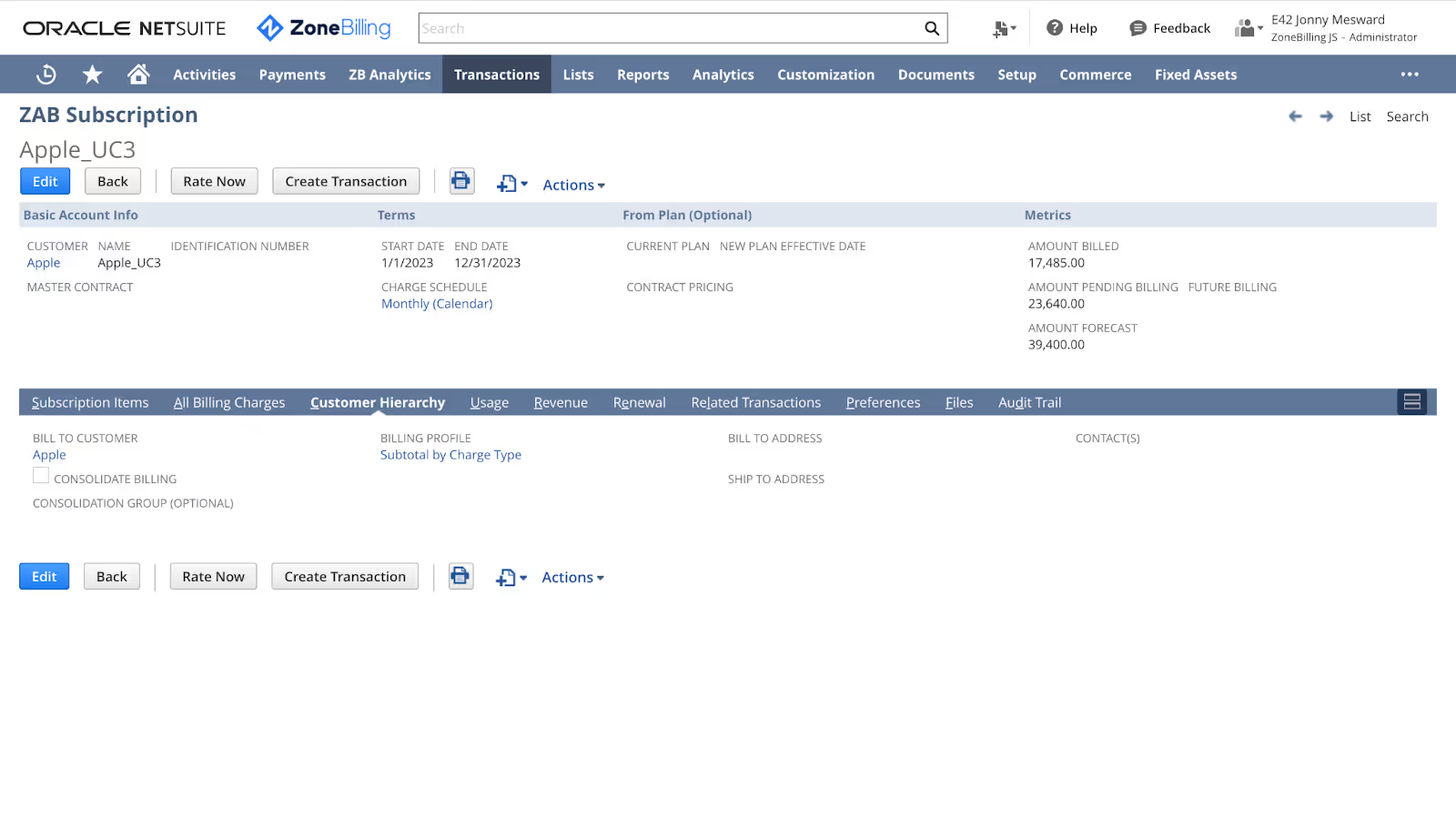

Automate subscription and consumption billing directly within NetSuite

Scale with confidence. ZoneBilling supports complex billing models and ensures accurate revenue recognition all within NetSuite.

Features: Revenue recognition, Salesforce integration

By reducing manual effort*

With ASC 606 and IFTS 15 compliance*

Automated by ZoneBilling

For peace of mind, anywhere

Automate contract billing for any price or product

Limitless billing, within NetSuite

No more spreadsheet calculations. ZoneBilling automates complex billing processes and integrates revenue recognition directly within NetSuite – including subscription, usage-based, project-based and other billing models within NetSuite. Our limitless billing frees up your team to scale and grow.

Reduce DSO with faster invoicing

No more manual workarounds to make an invoice. ZoneBilling is flexible and compliant to support complexities like usage, parent-child hierarchies and amendments. ZoneBilling automation improves invoicing and days sales outstanding (DSO) for optimized cash flow.

Fewer integrations, more efficiency

ZoneBilling is the #1 solution to elevate NetSuite quote-to-cash with a fully-configurable solution for billing, revenue recognition, and reporting. The result? Less 3rd-party systems, lower costs and more accurate reporting, no matter how many times a contract changes per year.

See how ZoneBilling delivers results

Get a Personalized

Demo Today

Discover how our innovative solutions are tailored to your specific business needs. Streamline your back-office operations, enhance efficiency and drive your business forward.

Powerful usage and subscription billing

Scale your business with confidence with ZoneBilling, designed to adapt to any billing, pricing or product model.

Subscription billing and amendments

Simplify contract renewals and amendments with automated workflows. Manage evergreen contracts, apply rate uplifts, adjust terms or modify usage quantities with ease. Reduce errors and improve invoicing for evolving customer agreements.

Easy amendments and credit memos

The ZoneBilling-CRM integration automates contract changes through the NetSuite record to the invoice and all the way to revenue recognition. Plus, ZoneBilling’s automated credit and debit memos are linked to the original transactions.

Consumption billing, streamlined for you

Easily bring in your consumption data via Zone’s API wrapper. Then ZoneBilling automates the usage calculations and rating so you can easily invoice customers by usage tiers, tier achievement, minimums, maximums, pooled usage and more.

Wraparound revenue recognition

A change in contract or usage shouldn’t create manual work for your team. ZoneBilling wraps around NetSuite’s Advanced Revenue Management (ARM) ARM to enable flexible performance obligation management, automate contract modifications, and deliver the structured data needed for accurate, compliant revenue recognition under ASC 606 and IFRS 15

Consolidated invoicing, flexible billing

Reduce DSO with ZoneBilling invoice automation that supports any pricing strategies your business needs. Easily bring all contract items onto a consolidated invoice, merged or separate according to the client’s needs. Plus, attach a CSV of detailed usage if needed.

Flexible account hierarchy

Simplify billing for complex organizational structures. ZoneBilling dynamically represents customer parent/child relationships, such as resellers, on contract objects. This means customers can change their bill-to with no impact on invoicing.

Built-in AI assistant

Get instant answers to billing and NetSuite questions, enabling faster onboarding and more efficient day-to-day operations. ZoneBilling’s native support makes it easier for users to navigate complex billing scenarios without leaving their workflow.

Explore our resources

Frequently asked questions

How long does it take to implement ZoneBilling?

Implementation timelines depend on the complexity of your business, as well as whether you are implementing NetSuite at the same time. Most implementations take several months. For more details, request a demo.

Can ZoneBilling support professional services billing and milestone billing?

Yes. Many subscription revenue billing solutions do not handle service revenue or milestone-based revenue very well. However, ZoneBilling can support your services billing – along with subscription, usage and one-time billing – on a consolidated invoice.

ZoneBilling customers have implemented billing for professional services, such as:

- Milestone billing

- T&M billing (time & materials billing)

- Percent complete billing (% complete billing)

- And more.

Can ZoneBilling handle usage billing and consumption billing?

ZoneBilling can handle and report on usage-based billing and consumption pricing including:

- Volume-based tiers

- Up-to billing

- Overages

- Billing in arrears

- Data mediation

- Prepaid usage

- Pooled usage

- Pay as you go

- AI-based pricing

- And more.

View this short video for more details on how ZoneBilling handles usage and rate calculations.

Can ZoneBilling handle subscription billing and recurring revenue?

Yes, ZoneBilling can handle and report on subscription billing, including:

- Recurring revenue

- Evergreen contracts

- Annual uplift / renewal uplift

- Co-termed upsells

- Minimum commitments

- Prepaid subscriptions

- Prorations

- And more.

For more details on ZoneBilling for subscription billing, view this short video.

What kind of reporting does ZoneBilling provide?

With our ZoneBilling and Zone Data Platform package, customers can track the complete quote-to-cash process. We bring together data from both Salesforce and ZoneBilling in NetSuite – providing insights into customer usage, MRR and ARR, retention, churn, drillable charge data and more.

Can ZoneBilling handle multi-currency and multi-subsidary scenarios?

Effortlessly manage global operations and expansion into new regions or with new acquisitions. ZoneBilling supports multi-subsidiary customers in NetSuite OneWorld and multi-currency transactions.

Can you configure ZoneBilling without scripting?

Yes. Say goodbye to custom scripting in NetSuite, which can break or fail with any NetSuite update. ZoneBilling is highly configurable but designed to work with your existing NetSuite records and setup.

Get a Personalized Demo Today

Start a conversation with an expert who asks thoughtful questions and shows you how Zone can solve your unique problem.

.avif)

.avif)